Employee Stock Ownership Plans (ESOP)

The most common reaction when ESOPs are mentioned as a business owner exit option is “Where would my employees get the cash to buy me out?” This makes ESOP transactions one of the most misunderstood liquidity alternatives open to corporate entities in the USA. Yet ESOPs are becoming one of the more popular tax-advantaged methods for effecting liquidity for private or closely held companies.

There are about 10,000 active ESOP plans in operation today. Most of these plans were established, under ERISA and IRS rules, to buy the shares of business owners some times in a series of transactions over a period of years. Because ESOPs are Qualified Benefit Plans as defined by Federal Law, they require strict adherence to rules set forth for these types of transactions under the Internal Revenue and Department of Labor regulations.

If these rules are followed correctly in planning, designing, and executing an ESOP program, there are meaningful tax advantages for both the selling shareholders and the company which establishes an ESOP benefit program for its’ own employees. Some of these tax advantages are not available to entities electing to be taxed as S-Corporations, LLCs, or Partnerships.

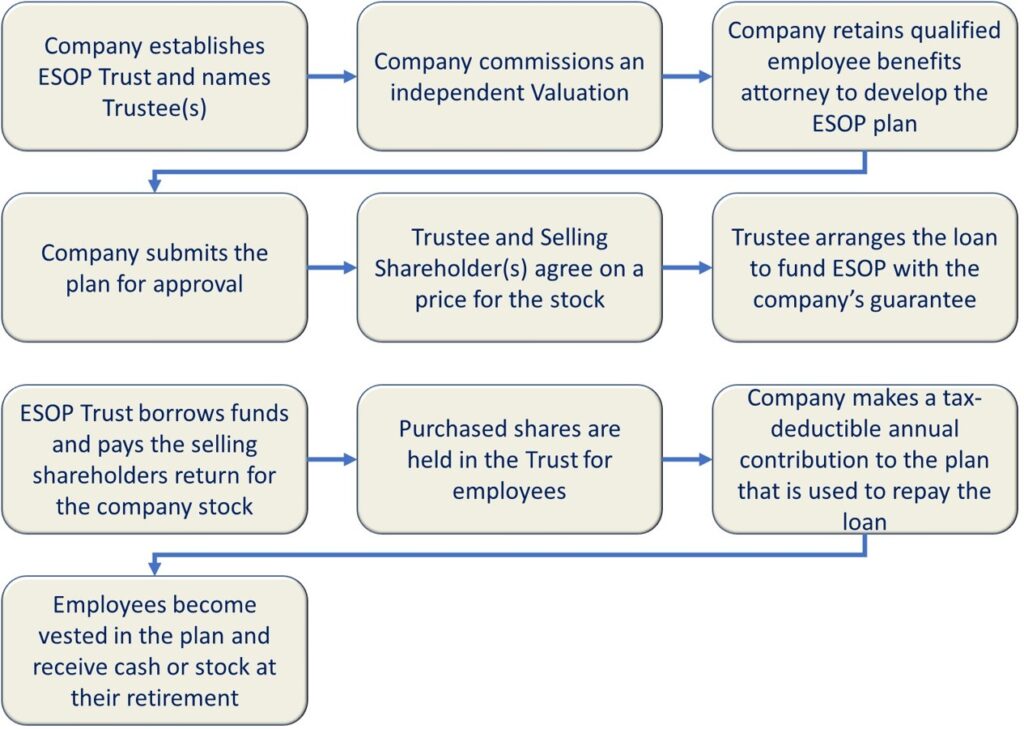

Usually, ESOP transactions look something like this:

Employees make no contribution to this plan. Selling shareholders of C corporations may enjoy a lifetime deferment of all capital gains taxes incurred as a result of the transaction. The company can deduct all of its annual contributions to the ESOP that are used to pay the interest and principal of the loan.

It should be noted that while ESOPs have significant benefits, they are complex transactions and require experienced, objective and qualified outside advisors to design and implement properly. There are severe penalties if the program contains omissions or errors.

The Beringer Group has extensive experience designing ESOPs and managing their implementation. We work only with experienced tax and ERISA practitioners who have completed hundreds of complex ESOP transactions.